how to calculate tax

Our tax refund calculator will show you how. Top-rated and Trustworthy Software Company for US expat Tax Services.

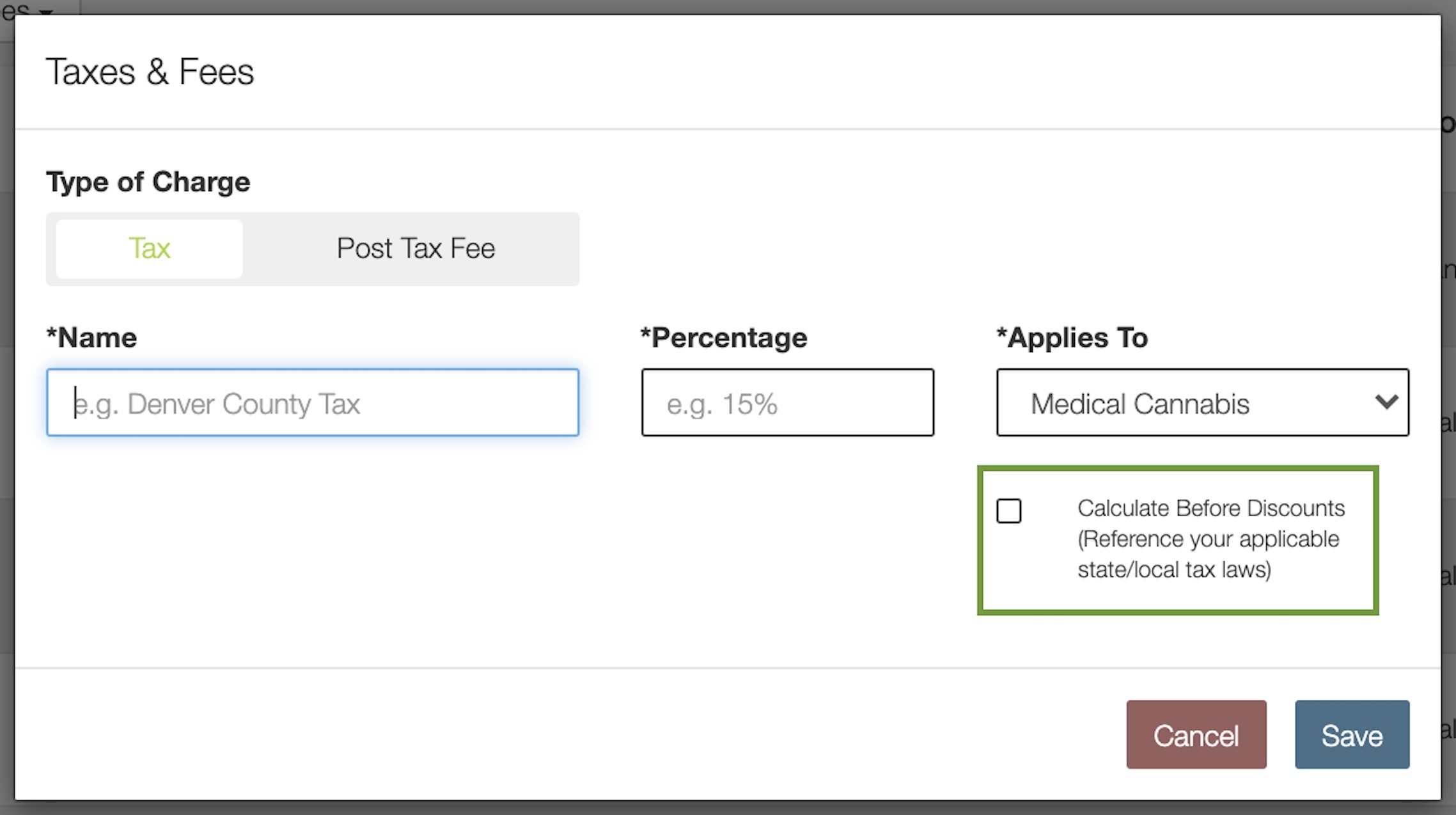

How To Calculate Cannabis Taxes At Your Dispensary

Use Notice 1392 Supplemental Form W-4 Instructions for Nonresident Aliens.

. Speaking of the IRS they say if you pay 90 of what you owed in taxes last year youll be safe. FAQ Blog Calculators Students Logbook. Our income tax calculator calculates your federal state and local taxes based on several key inputs.

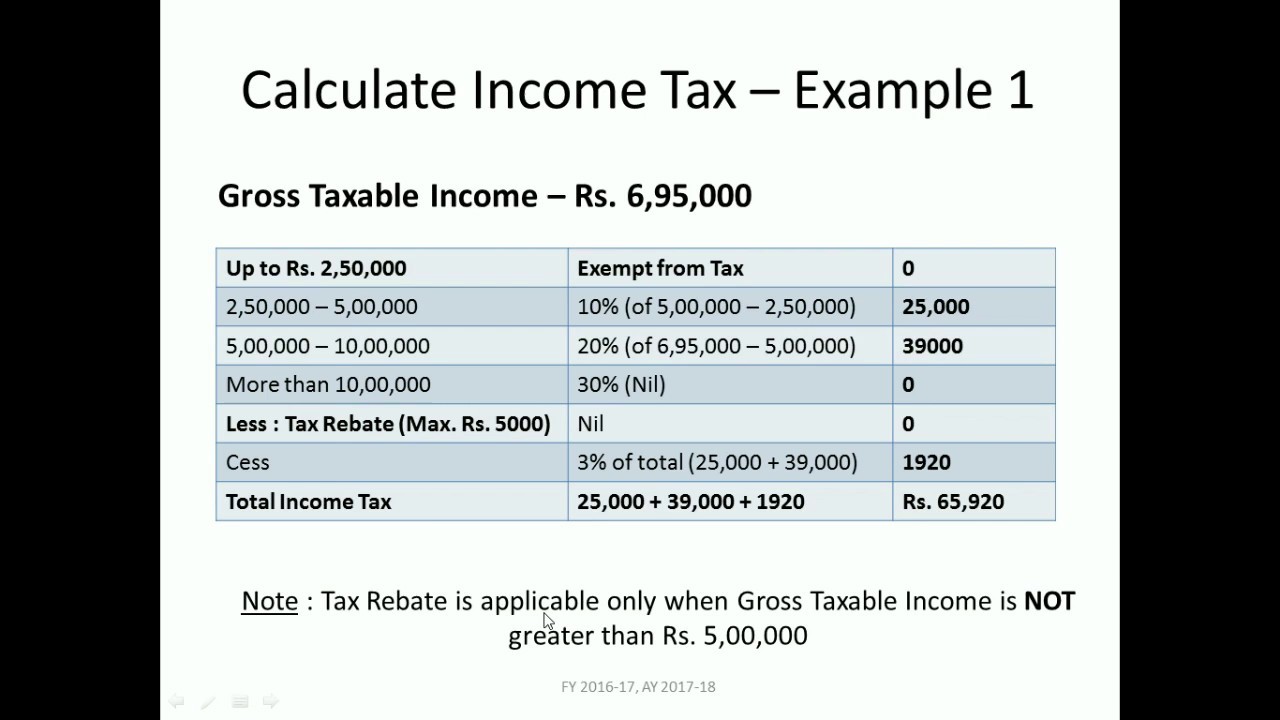

House Rent Allowance HRA 2. Next Stephanie multiplies her adjusted gross income by her income tax rate according to the 2023 tax bracket to find her tax due. Federal Income Tax Return Calculator Estimate how much youll owe in federal taxes using your income deductions and credits all in just a few steps with our tax.

If you make 55000 a year living in the region of New York USA you will be taxed 11959. Between 50271 and 150000 youll pay at 40 known as the higher rate. It can be used for the 201314 to 202122 income years.

You have nonresident alien status. Top-rated and Trustworthy Software Company for US expat Tax Services. Section 80C 80CCD 1 and.

The tax year The tax year is the previous financial year for which the income tax is calculated. Use our 1040 income tax calculator to estimate how much tax you might pay on your taxable income. Your tax bracket is determined by your taxable income and filing status.

Income Liable to Tax at Normal Rate --- Short Term Capital Gains Covered us 111A 15 Long Term Capital Gains Charged to tax 20 20 Long Term Capital Gains Charged to tax. Access Top US Expat Tax Service In Minutes. 54 rows The Sales Tax Calculator can compute any one of the following given inputs for the remaining two.

Multiply price by decimal. Youll have to estimate what you owe each quarter and pay that amount to the IRS. Various deductions to calculate income tax on salary 1.

On income between 12571 and 50270 youll pay income tax at 20 - known as the basic rate. Divide tax percentage by 100. Income Tax Calculator The Income Tax Calculator estimates the refund or potential owed amount on a federal tax return.

The first 9950 is taxed at 10 995 The next 30575 is taxed. Estimate your tax withholding with the new Form W-4P. Itemized deductions Standard deductions lower.

Using the brackets above you can calculate the tax for a single person with a taxable income of 41049. The financial year starts from April 1 and ends on March 31 of the next year. The price of the coffee maker is 70 and your state sales tax is 65.

The above calculator is only to enable public to have a quick and an easy access to basic tax calculation and does not purport to give correct tax calculation in all circumstances. Tax brackets change each year. 65 100 0065.

Ad Information for entrepreneurs. Ad Confused About US Expat Taxes. Ad Information for entrepreneurs.

And is based on the tax. Income Filing Status State More options After-Tax Income 57688 After-Tax. Before-tax price sale tax rate and final or after-tax price.

Access Top US Expat Tax Service In Minutes. Your household income location filing status and number of personal. Your average tax rate is.

List price is 90 and tax percentage is 65. Simple tax calculator This calculator helps you to calculate the tax you owe on your taxable income for the full income year. Business in The Netherlands.

Business in The Netherlands. It is mainly intended for residents of the US. Leave Travel Allowance LTA 3.

Ad Confused About US Expat Taxes. Use our employees tax calculator to work out how much PAYE and UIF tax you will pay SARS this year along with your taxable income and tax rates. That means that your net pay will be 43041 per year or 3587 per month.

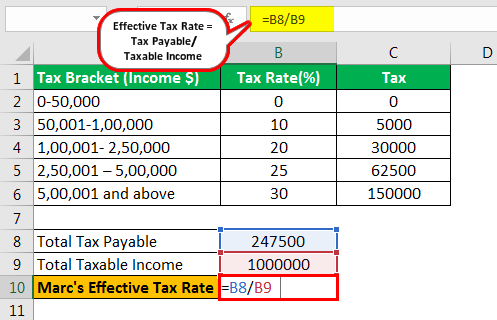

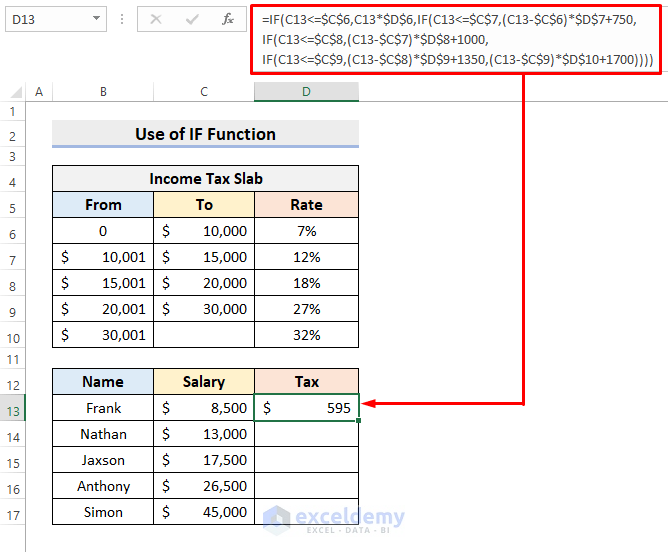

Income Tax Formula Excel University

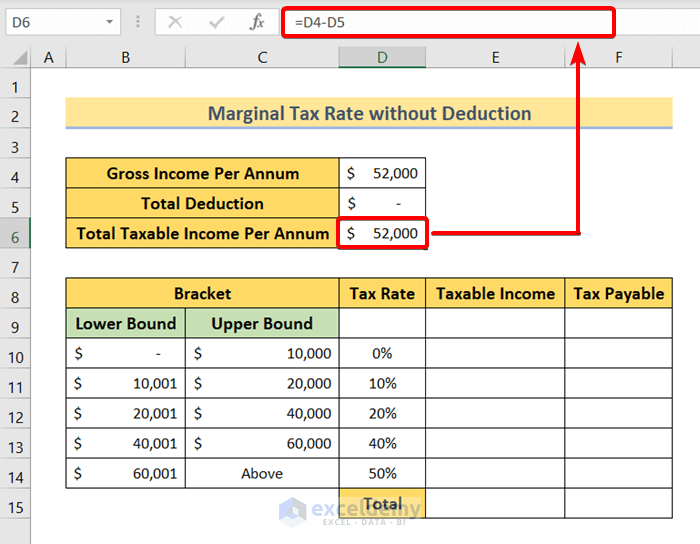

Marginal Tax Rate Definition Formula How To Calculate

How To Calculate Marginal Tax Rate In Excel 2 Quick Ways Exceldemy

How To Make An Equation That Calculates The Price Before Tax Quora

How To Calculate Payroll Taxes Futa Sui And More Surepayroll

How To Figure Out And Calculate Sales Tax Math Wonderhowto

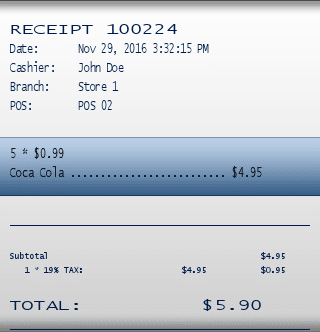

How Does The Pos Calculate Sales Tax Korona Pos Manual

How To Calculate Income Tax In Excel Using If Function With Easy Steps

Excel Formula Tax Rate Calculation With Fixed Base Exceljet

Federal Income Tax Calculating Average And Marginal Tax Rates Youtube

California Sales Tax Rate Rates Calculator Avalara

How To Calculate Tax On Income Online 60 Off Ilikepinga Com

How To Calculate Iso Alternative Minimum Tax Amt 2021

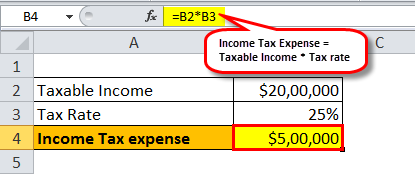

Income Tax Expense On Income Statement Formula Calculation

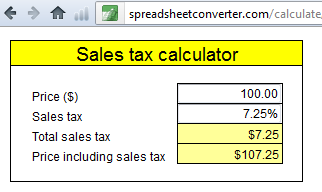

Create A Simple Sales Tax Calculator Spreadsheetconverter

How To Calculate Taxable Income H R Block

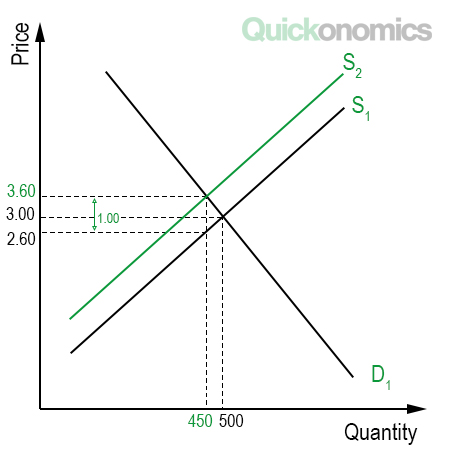

How To Calculate Tax Incidence Quickonomics

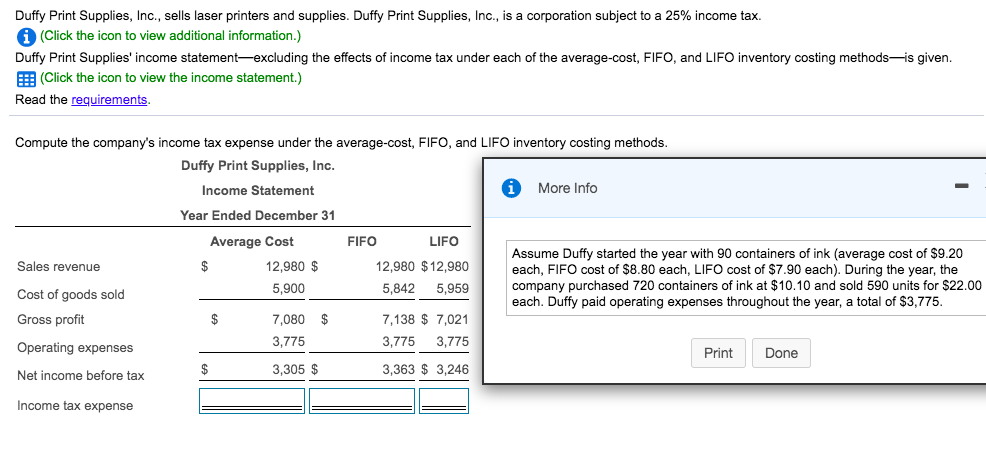

Solved How Do I Calculate Income Tax Expense For Average Chegg Com

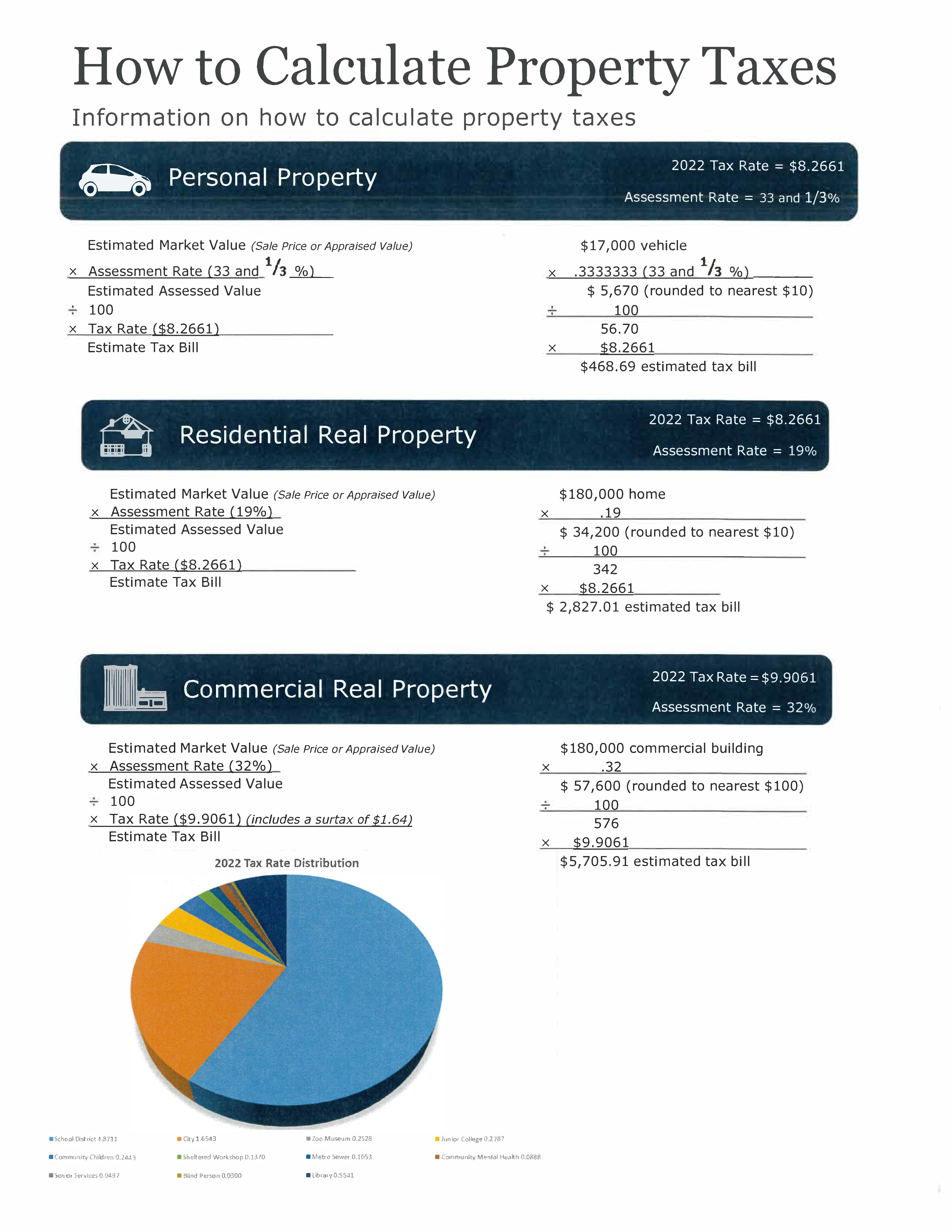

Comments

Post a Comment